At Lendtable, our team's number one value is Be Worthy of Trust. We aim to create clear and transparent financial products for our customers. However, personal finance is complex, and our product must account for scenarios such as taxes, investment returns, and interest rates that can understandably lead to confusion.

Today, I will take some time to address some of the most common misconceptions we hear about our product.

Misconception 1: You will lose money using Lendtable.

We often hear this concern from people, and the common misperception is that Lendtable customers will not have the means to pay us back or will have no savings remaining after they do. This is incorrect for many reasons, but I will start with the most important one:

Lendtable only charges a profit share fee if you receive 401(k) matching contributions.

Simply put, our fees cannot exceed the 401(k) match money you earn, as our fee depends on whether you receive a match from your employer. This means that if a customer chooses to pay us back using funds they have withdrawn from their 401(k), they will still be able to cover our principal and share of the match.

Our profit share is only on the match, not the investment returns.

Our pricing is simple: we take 20% of the after-tax 401(k) employer contribution and charge a $10 membership fee each month to keep the lights on.

We will only give you enough to get your full match so every dollar we give you earns an immediate return.

For you to not have enough match money left in your 401(k) to pay us back, the investment returns on your 401(k) would need to decrease catastrophically.

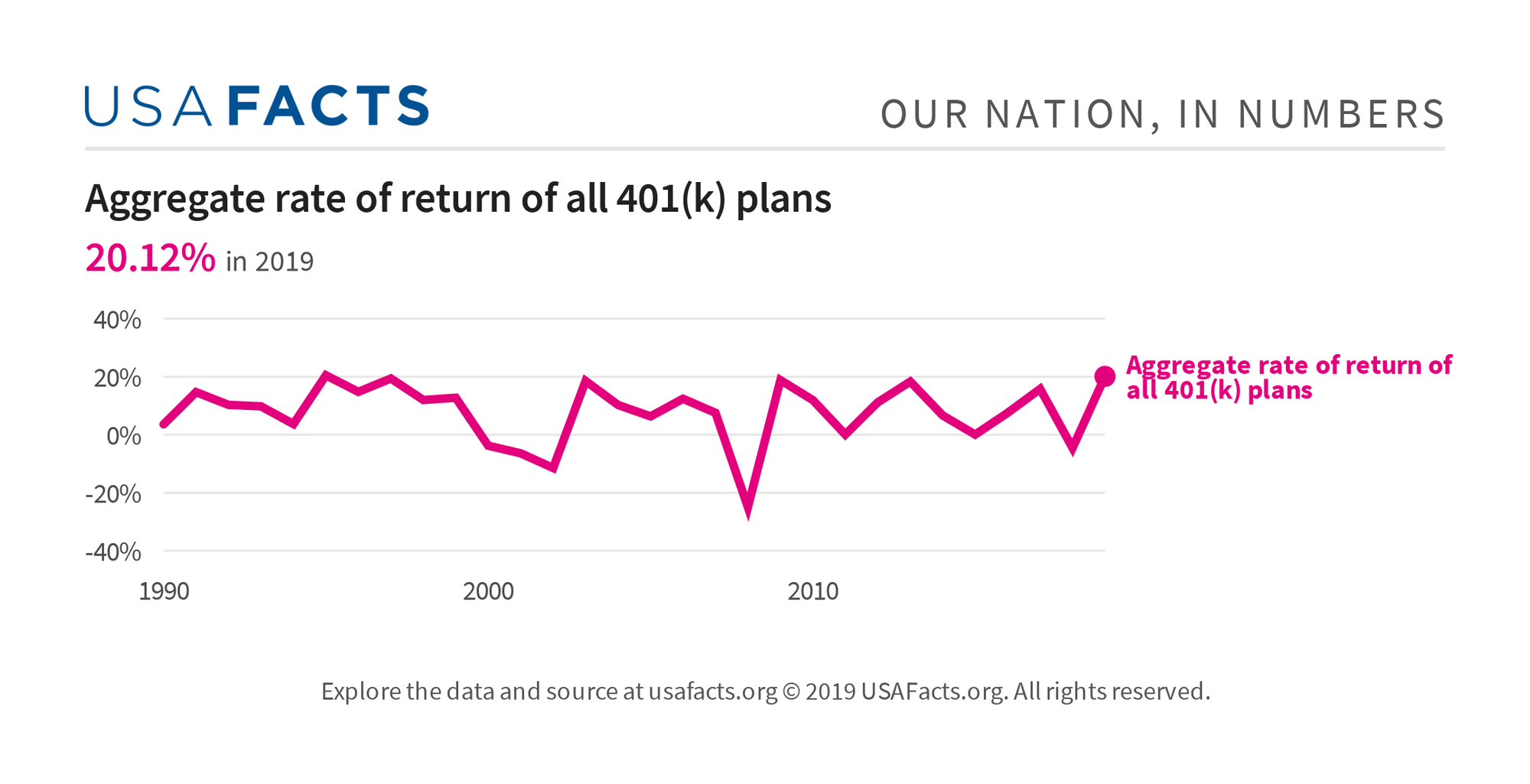

401(k)s typically grow at an annual rate of 5-8%. Even if your 401(k) experiences a decline, the gains from getting your match would significantly outpace the market decline in almost all cases. For example, if you have a dollar-for-dollar $5,000 pre-tax match, after Lendtable’s fees you will keep $4,000 in your 401(k) if your 401(k) returns 0% growth. If the market declines 30% (remember – since 401(k) contributions are made monthly this would need to be roughly a 30% monthly decline), your $5,000 match will now be worth $3,500. After Lendtable’s fees, you would still have roughly $2,500 in your 401(k) even after a 30% loss in 401(k) value. For you to break even and make no money with Lendtable in this scenario, your 401(k) losses would have to be almost 50%. The US Department of Labor’s data shows that the worst performing 401(k) year since 1990 has been -25% (see chart above).

Misconception 2: When you pay taxes and penalties, you will be left with less in your 401(k) and in your pocket than when you started.

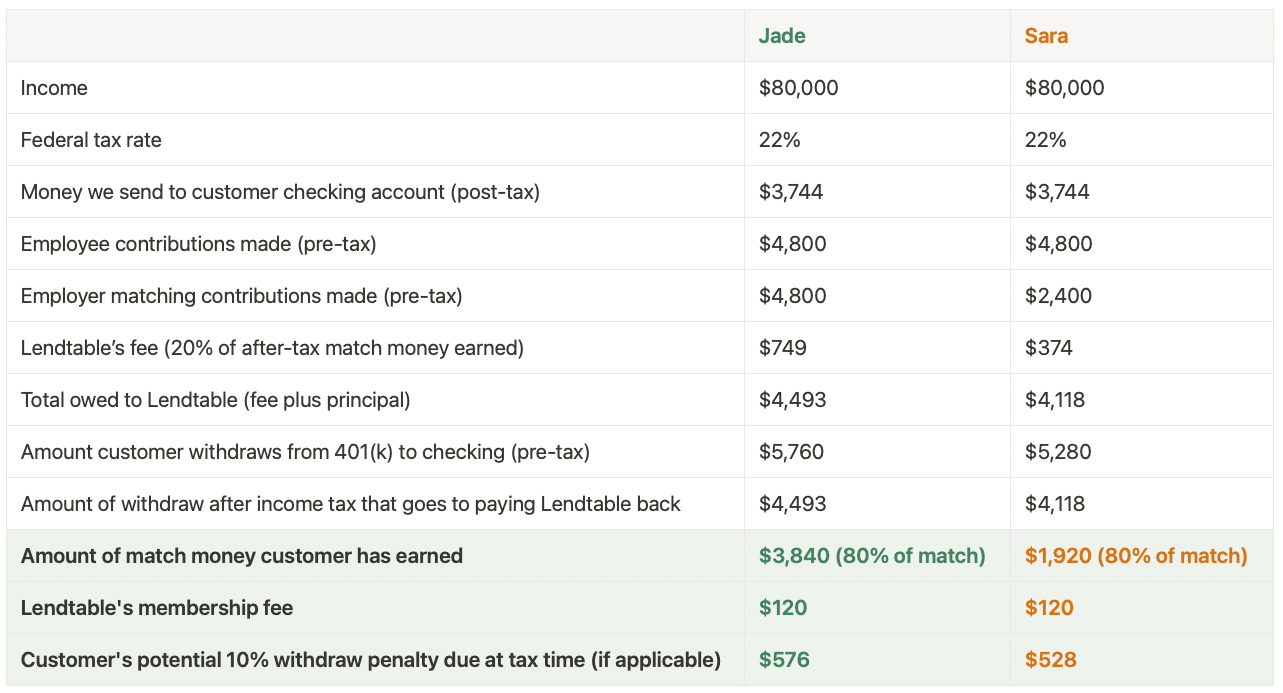

This statement is also false. Let's consider an example of two customers, Sara and Jade. Sara is 35 years old, earns $80,000 per year, receives a 50-cent match for every dollar she contributes up to 6% of her salary, and has a federal income tax rate of 22%. Jade is 27 years old, earns $80,000 per year, receives a dollar-for-dollar match up to 6% of her salary, and has a federal income tax rate of 22%. Here's a breakdown of their savings (spoiler alert: both of them end up with thousands saved for retirement).

Even after paying all taxes and fees, Jade and Sara end up in a much better position than if they hadn't used Lendtable and missed out on their 401(k) match. It's important to remember that the money they earned will continue to grow through investment returns. That's the purpose of Lendtable - to help you start saving for retirement even if you don't have the cash on hand to get your full 401(k) match.

Misconception 3: Ok, but isn’t Lendtable is the same thing as a personal loan?

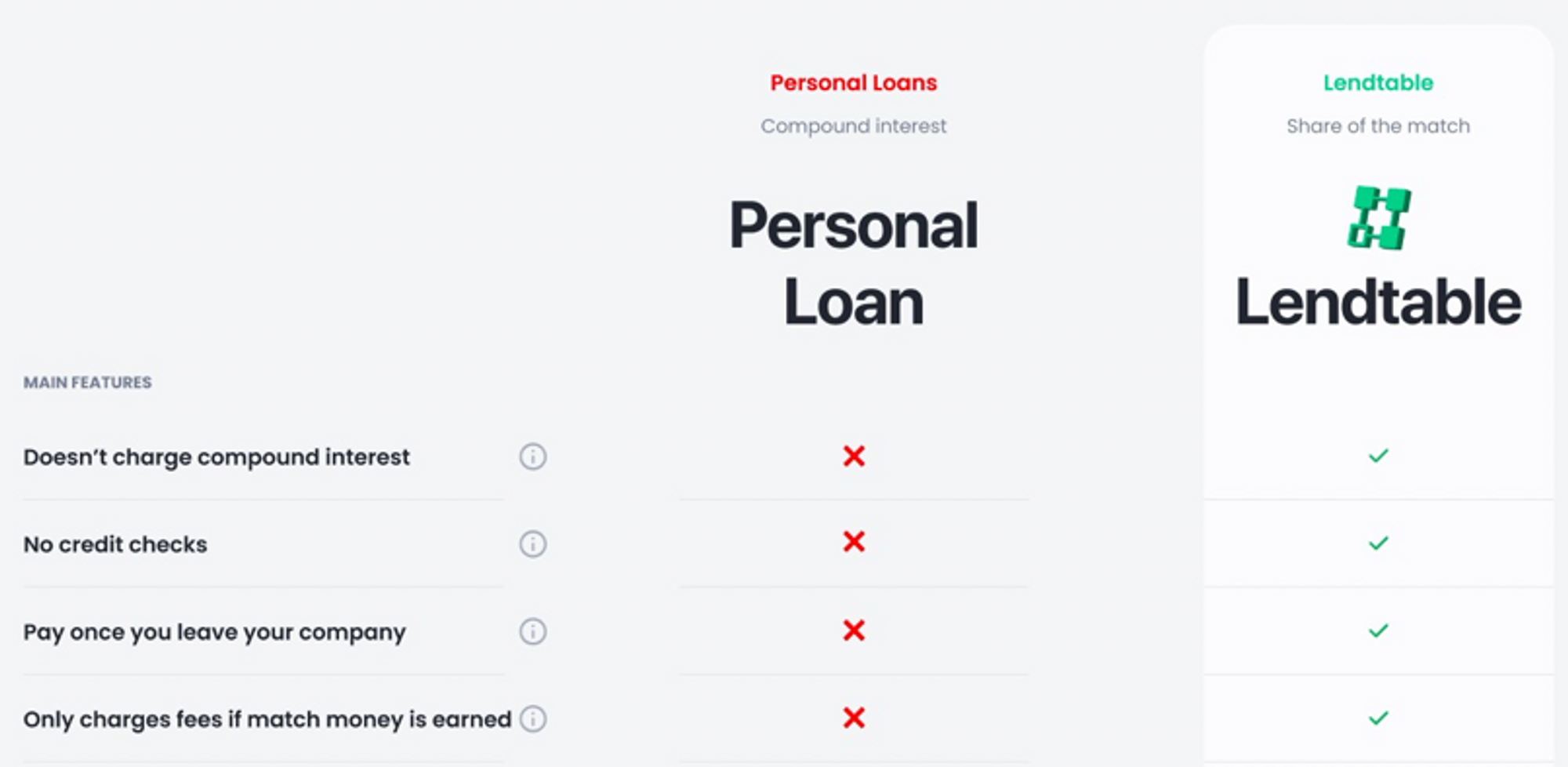

This statement is inaccurate for several reasons. Firstly, we do not charge any interest, whether simple or compound. Our fee is only a share of the employer match money that we help you earn. This means you get to keep a lot more of what you earn than you would with a traditional personal loan.

Secondly, we do not conduct a credit check when you sign up, so there is no impact on your credit score when you apply to use Lendtable. Let's take a closer look at these critical points.

We do not charge compound or simple interest. Personal loans and credit cards are pure loans, and customers are typically expected to begin paying them back immediately. Compound interest is charged on the unpaid balances each year.

Compound interest can be a powerful tool for investing, but it should be used with caution when it comes to lending. If you do not pay off a personal loan or credit card in a timely manner, you could end up paying more in interest than the original principal balance.

At Lendtable, we charge only one profit share fee that does not accrue any interest. For example, if you earn $1,000 in match money and your tax rate is 25%, Lendtable's fee will be $150. Even if you haven't made a payment towards your balance two years from now, Lendtable's fee will remain at $150. This is not the case with a personal loan.

Pay us back when you leave your company. Now imagine a Lendtable customer who cannot currently afford to get their 401(k) match and cover their bills.

If they use a personal loan to cover the money they would contribute toward their 401(k) match, they may need to pay that back over a year. This would be the same as if they just contributed to their match without a loan.

If, for any reason, they do not earn their anticipated match (for example, the employee leaves their company before their matching contributions vest), they would still owe the same loan and interest rate regardless of their profit made. This could result in a significant loss. If this person uses Lendtable, our fee reflects the actual match earned. This means it only kicks in if they actually receive employer contributions.

At Lendtable, you do not pay back Lendtable’s principal and fee until you leave your employer. There are no monthly principal and interest payments, as with a personal loan.

In summary, with Lendtable, you do not have to pay us back in monthly installments aside from your platform fee. You get to keep your income the same even though some of it is now going towards your 401(K) match. No additional interest is added to what you owe us each year your money is outstanding. If anything happens and you do not receive employer matching contributions, our fee will always be 20% of the employer contributions you actually earned.

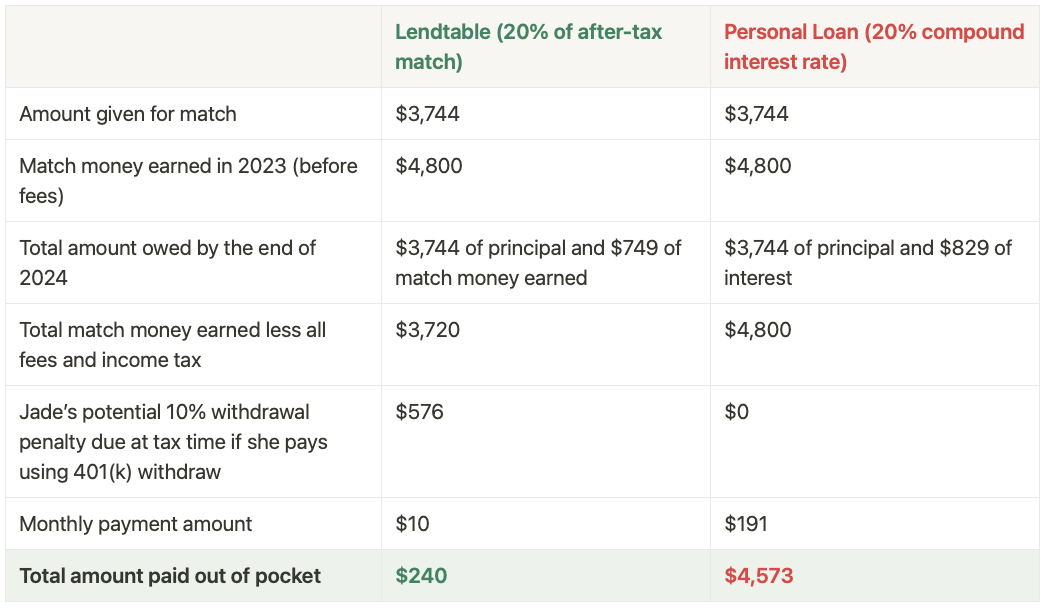

What does this really mean for you when we break down the numbers? Let’s go back to Jade from earlier. Let’s say she is considering using Lendtable vs. a personal loan and will end up staying for 2 more years. Here is how both options would turn out:

With Lendtable, Jade can earn roughly 80% of her 401(k) match money while maintaining her out-of-pocket spending money. With a personal loan she will need to pay thousands of dollars out of pocket in order to get her match. Simply put, Lendtable is very different than a personal loan. Loans serve a completely different purpose than helping you get your 401(k) match. Lendtable on the other hand, is only here to serve that exact need. Our core goal is to help Lendtable customers save as much match money as possible for retirement by enabling them to start getting their 401(k) match.

Misconception 4: Lendtable is bad for your credit.

We do not check your credit to decide if you are eligible to use Lendtable Your credit score will not be impacted by signing up for Lendtable, as we do not make any hard inquiries on your credit report.

In the event that you do not begin making payments to your Lendtable balance on time (28 days without verifying you are still working at your employer or 14 days after you have left your employer), Lendtable reserves the right to inform credit bureaus which could affect your credit score, but our team is available around the clock to help you make a plan long before this ever happens.

So there you have it. Lendtable can be (and is) a great option for many U.S. employees.

Every person's financial situation is unique, and we understand that only you can determine whether Lendtable is right for you. Our role is to ensure that you can make an informed decision by providing transparency and a clear understanding of how our product works.

Thousands of customers have relied on Lendtable to get their 401(k) match and ESPP. Each one has had unique and important reasons for doing so. Our customers have shared stories about how Lendtable has helped them contribute to their 401(k) for the first time, allowed them to continue getting their match as they made a down payment on a mortgage, and more.

With so many people helped, we're not stopping here. There is much more work we can do to spread financial empowerment to even more Americans. We hope that you will join us on this journey in one way or another.

Lendtable is a consumer financial services platform. Lendtable is not a bank. Lendtable does not offer tax, legal, investment, or financial advice. Always consider your personal situation when making financial decisions.

Mitchell Jones

Mitchell Jones