Picture this: Although you’ve been in the workforce for a few years now, you still don’t totally understand how corporate benefits work. That said, one thing you’re certain of is that contributing to your 401(k) is key to securing a timely retirement. As a result, you maxed out your 401(k) the moment your company started offering one, took advantage of your employer match, and built up quite the nest egg in your 401(k) account. (Nice job! Give yourself a pat on the back for being so financially responsible.)

Now, after working at the same company for a few years, you find a new position with even better pay. All is right with the world.

But then, one day you’re talking to a coworker at your new job about retirement planning, and they ask what you did with your old 401(k). Your stomach drops and eyes go wide—you haven’t thought about that in months. You stammer out a nonsense answer, return to your desk, and frantically look up “What happens to my 401(k) when I leave my job????”

Luckily, you find this article.

Here’s what to do with an old 401(k), and how to roll it over into an individual retirement account, or an IRA, in five steps. Easy peasy.

Step 1: Take a deep breath

First things first: Don’t worry. Like anything worth doing, rolling over an old 401(k) into an IRA takes some effort, but when you know what to expect, you’ll realize it’s a lot easier than it seems.

It’s also important to remember that no matter how long it’s been since you left the company that previously sponsored your 401(k), that money is still in your account waiting for you. In other words, your previous employers aren’t just going to throw your savings away. (In fact, they’re legally not allowed to.)

So take a deep breath, keep reading, and let’s get this all figured out.

Step 2: Consider your options

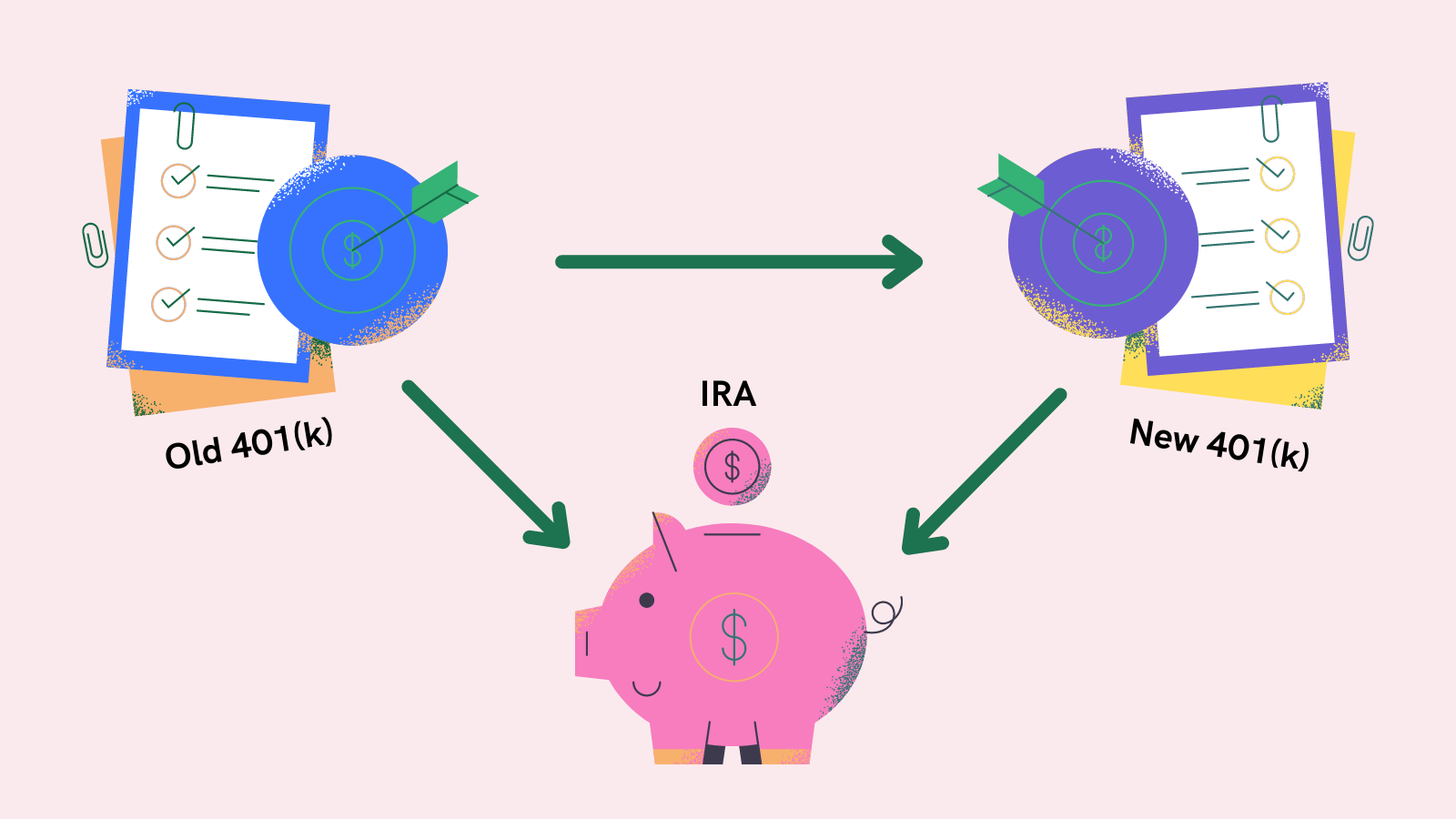

When rolling over your 401(k), there are generally four options available:

Keep your 401(k) with the former employer

Even if you don’t work at a particular organization anymore, the 401(k) you set up through that organization still stands. The money you have in that account will continue to earn compound interest, and you will be able to cash it out when retirement comes around.

However, it’s important to keep in mind that because 401(k)s are company-sponsored retirement accounts, you cannot put any more money into this account if you no longer work at the company you set it up with.

One reason you might make this choice: In the short term, this is the lowest-effort option. Also, your old 401(k) account may offer different investment options than your new one—if you have noticed that your former employer’s 401(k) has shown significant growth since you set it up, it might be worth keeping some money in there.

One reason you might not make this choice: Your retirement savings will be scattered among different accounts, so you’ll have more to keep track of in the long run.

Consolidate your 401(k) accounts

If your new employer also offers a 401(k), they will likely allow you to roll over your old 401(k) into the new one. Your Human Resources department should be able to help you do this.

One reason you might make this choice: Once you roll over your old 401(k)—meaning, once you move the money from one account to another—you will have all your company-sponsored retirement savings in one place. You will also be able to regularly—and automatically, if you set up automatic paycheck deductions—contribute to this new account. This means, for the most part, the maintenance of your 401(k) is out of your hands, which means less work for you!

One reason you might not make this choice: As we mentioned before, your old 401(k) plan might have more favorable investment options than your new one. While you should always take advantage of whatever retirement plan your current company offers, it might be advantageous to keep some money in the old account.

Roll over the money in your 401(k) to an IRA

Perhaps the most common and flexible option: Rolling your 401(k) assets into an IRA. If you don’t already have an IRA, don’t worry: They’re easy to set up, and they can act as your catch-all retirement savings account. That means that no matter how many times you set up a 401(k) and subsequently leave that company, you can always roll those assets into this one account.

IRAs also provide some serious tax benefits and offer more investment options than most 401(k)s, so they’re helpful to have in general.

One reason you might make this choice: In addition to tax benefits, investment options, and reduced management fees, you’ll have a retirement account connected to you, not any particular employer, where you can always put your retirement savings. In other words, unlike 401(k)s, IRAs give you total control over your retirement savings.

One reason you might not make this choice: This is the most hands-on option, and might add another step or two to the rollover process. That said, it’s not that hard: Read on, and we’ll walk you through it.

Cash out your 401(k)

Before we move on, this option is worth mentioning for transparency’s sake: Technically, you can cash out the money you collected in your old 401(k) if you want to. However, the main advantage of a retirement account like a 401(k) is compounding interest, which means you’ll see gains on the initial contributions as well as the interest accrued from those contributions, so you’ll probably end up losing money in the long run if you cash it out.

Additionally, you will be charged income taxes on your withdrawals, and, if you are under 59 ½ years old, you’ll be charged a 10% early withdrawal penalty fee.

Basically, you should only consider this option if it’s an absolute emergency.

Step 3: Choose your IRA type

Made the choice to roll over your 401(k) into an IRA? Excellent! There’s one more thing to consider before you can get your money moving: Which type of IRA should you open?

There are two main types of IRAs: Traditional and Roth.

As a reminder, “traditional” means taxes are taken out when you withdraw, so you’ll see a higher balance in your account but you’ll lose a portion to taxes when you take out your assets. “Roth,” on the other hand, means taxes are taken out when you contribute, so you’ll pay those fees up front, but the money you see in your account is the money you’ll actually have available to you.

The benefits of each are relatively straightforward, but your choice will also depend on what type of 401(k) you began with. Like IRAs, 401(k)s come in traditional and Roth versions.

If you have a traditional IRA, you have two options:

Traditional 401(k) to traditional IRA

Do this, and you won’t have to pay any taxes on the rollover. However, you are required to roll over everything in the account—in other words, you can’t roll over some of the 401(k) money into the IRA, and leave some in the 401(k). It’s all or nothing with traditional-to-traditional rollovers.

Traditional 401(k) to Roth IRA

Because Roth accounts take taxes from your contributions, you will have to pay taxes on the amount that you roll over into the Roth IRA. However, once your money is in the IRA, it won’t be taxed, even when you withdraw it.

Now, if you have a Roth 401(k), you only have one option:

Roth 401(k) to Roth IRA

If you have a Roth 401(k), this is your only option. Because you already paid taxes on your contributions to your Roth 401(k), you will not have to pay additional taxes when you roll your money over into a Roth IRA.

Step 4: Get ready to roll (over)

Once you’ve decided which type of 401(k) you have and which type of IRA you can use for the rollover, you have to open the IRA so it’s active and ready to receive your 401(k) assets.

You can learn how and where to open your IRA here.

Once your IRA is set up, you have two rollover options:

Direct rollover

A direct rollover means your former 401(k) provider will transfer your money directly to your IRA. This takes some of the burden off of you, but you still have to give the 401(k) provider the information it needs.

First, contact your former 401(k) provider and tell them you would like to do a direct rollover into an IRA. They’ll direct you to the forms you’ll need to complete to do so. Usually, you’ll be able to choose if they send a physical check or initiate a wire transfer to your IRA provider.

You should be notified once the transfer is complete, and you should see your new balance in your IRA.

Indirect rollover

If, for some reason, you cannot do a direct rollover, you can do an indirect rollover. An indirect rollover means you will cash out your 401(k) balance and put that money into your IRA yourself.

Because cashing out a 401(k) balance usually incurs taxes, the 401(k) provider will likely hold 10 to 20% of your 401(k) balance to “pay” these taxes. However, if you roll over your entire 401(k) balance into your IRA, you will usually get that money back via a tax refund. The 401(k) provider will be able to give you more details on their indirect rollover protocol.

Step 5: Invest your funds and watch them grow

Once you move your 401(k) money into an IRA, you have one final, crucial step: Invest it! The #1 biggest mistake people make is putting money into an IRA and letting it sit there.

IRAs are not savings accounts, they’re retirement accounts. That means that the main draw of IRAs is the investment options they offer, which can provide huge gains on your principal contributions once it comes time to retire.

Not sure where to invest your money? Everyone’s investment breakdown looks different, but it’s helpful to first assess your risk tolerance. Are you okay with high-risk investments with potentially high rewards (or potentially big losses)? Or would you rather be more conservative with your money and put it into investments that will make steady but more modest gains.

Once you have an idea of your risk tolerance, consider these options: Low-risk investments include savings bonds, money market funds, treasury bills, and certificates of deposit, also called CDs.

Higher-risk investments include mutual funds, bonds, private stocks, and exchange-traded funds, also called ETFs. Keep in mind, some of these higher-risk investments, like mutual funds and stocks, are also the most popular choices for IRA investments.

Regardless of your risk tolerance, having a mix of investments is always a good move. This is called “diversification,” and it protects you from total loss if one investment goes sour.

The 4-1-1 on 401(k) rollovers

Moving companies and taking advantage of new retirement benefits is exciting, but it always comes with some maintenance of your old accounts. The worst thing you can do is procrastinate dealing with your retirement savings—it will only lead to missed opportunities and higher financial anxiety for you!

Ultimately, educating yourself and making sure you are financially literate is the best thing you can do for your finances.

Julia Sachs

Julia Sachs