Some of the Lendtable team outside our new Headquarters in San Francisco

(Photo Credit: Siddhi Surana / @shot.by.sid)

Some of the Lendtable team outside our new Headquarters in San Francisco

(Photo Credit: Siddhi Surana / @shot.by.sid)

When we announced Lendtable's seed raise a year ago, we set out to prove we could build a thriving fintech business that enables new people to begin saving for retirement instead of creating more products for those already investing. Although many investors were skeptical, we argued that the reason 1 in 5 people did not receive thousands of dollars in the form of a free 401(k) employer match was not that they were "misinformed" or "did not care enough.” It was because they were getting squeezed. They were choosing to pay their student loans. They were choosing to feed their families. They were choosing to pay off their mortgage. They were making the right choices for their today at the expense of their tomorrow.

Those choices hit close to home. They are the same ones my mother and father made by putting every dollar they earned towards providing a better life for my brother and me. My parents and hundreds of our customers constantly have to sacrifice long-term financial security to make ends meet, pay off education and medical expenses, and provide their loved ones opportunities they themselves never had the chance to pursue.

These sacrifices are what make my parents and our customers the real heroes. It is why Lendtable's mission is much larger than giving out cash for 401(k) matches and Employee Stock Purchase Plans; we are one company contributing to the greater fight to enable a secure financial future for every person.

This fight matters for more than just my family and the average American household. Our society benefits when every individual has the power to participate in our economy. Their participation fuels small business growth, entrepreneurship, innovation, startups, and so much more. However, we are quickly approaching a crisis no one is talking about.

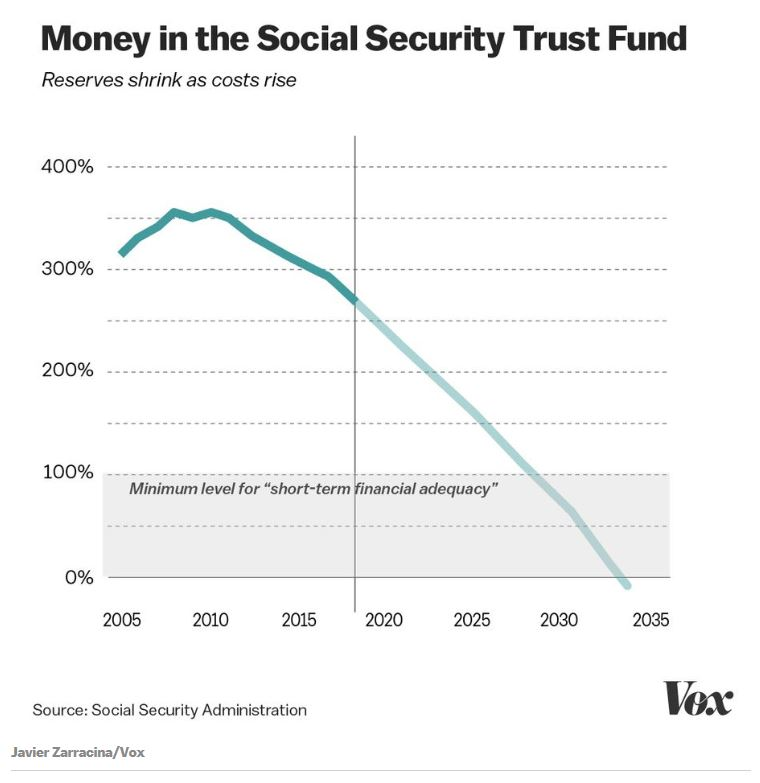

1 in 4 Americans still have no retirement savings, and about 60% of people at or near retirement age do not have enough money to retire. Many of these Americans believe that social security will support them in retirement. Meanwhile, the Social Security Trust is projected to run out of money in 2033, a year earlier than previous projections, due to Covid.

This investing crisis will change every part of American life, even for those already financially prepared for retirement.

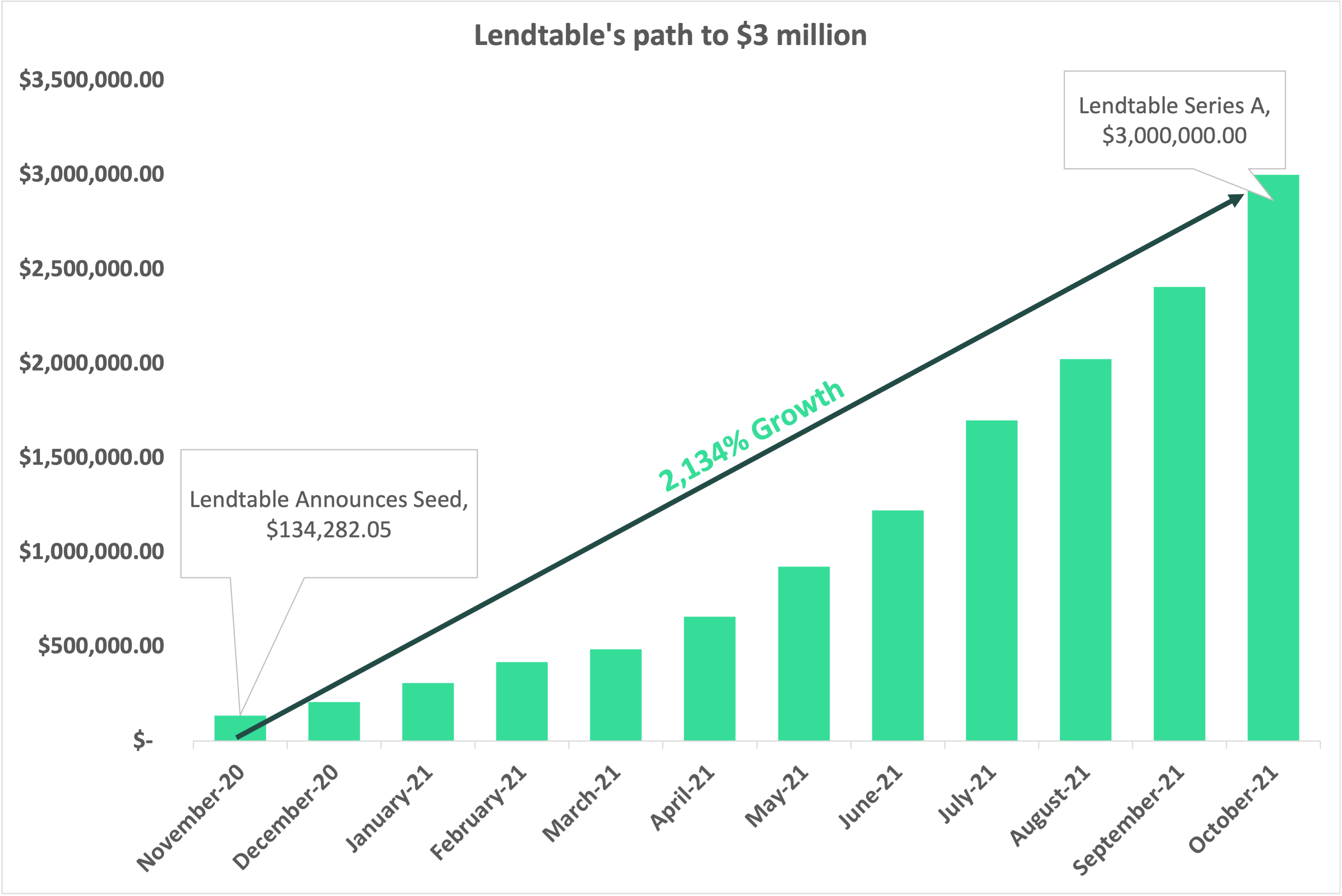

Our team is deeply committed to enabling a future in which every individual can retire at 60 years old. A year ago, we had provided a little more than $134,000 to our customers to help them receive their 401(k) employer matches.

Fast forward to today, and we have provisioned more than $3 million, growing our business by about 22x over that period. To accelerate our growth, we need to expand our team, product offerings, and brand reach even faster than we already have. This leads me to the heart of this article:

I'd like to formally announce Lendtable's Series A raise of $18 million.

The round is led by Dick Costolo, Adam Bain, and the team at 01 Advisors. In addition to the 01A team, we welcome back Streamlined Ventures, SoftBank Opportunity Fund, Valor Equity Partners, and Dragon Capital participating in this round. Finally, we are excited to announce Dennis Woodside (COO of Impossible Foods), Anthony Noto (CEO of SoFi), Rich Antoniello (CEO of Complex), Zander Lurie (CEO of Momentive, formerly SurveyMonkey), and Jay Parikh (former VP of Engineering at Facebook) as strategic angels partnering with us in this round. This capital brings our total money raised to $24 million.

"We are thrilled to partner with Mitchell and Sheridan through our investment in Lendtable. They have put together a phenomenal team, and we are impressed with how fast they've moved on such an enormous problem. The retirement industry is large and ripe for improvement, and Lendtable solves the core liquidity issue with the space." - 01 Advisors

We thank all of our new teammates for joining us on this journey. Their expertise and capital will help us unlock a step-function change in Lendtable's growth. Specifically, we will use our new funding to triple our team size in the next year, continue growing the core Lendtable 401(k) and ESPP products, and expand our reach into strategic partnerships that make it even easier for our users to find and use Lendtable.

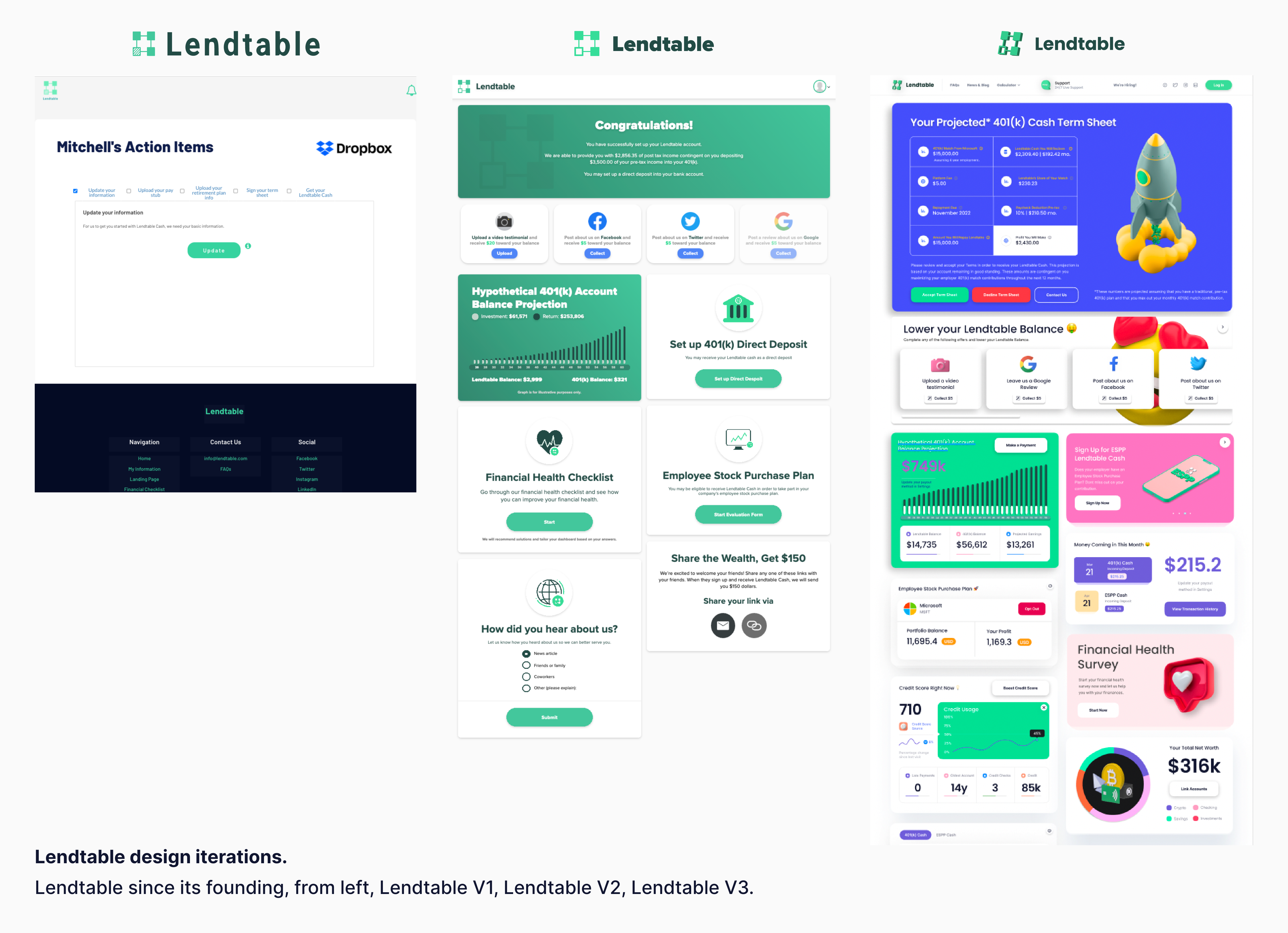

It is essential to highlight the work that got us to this incredible milestone. Our team has been working around the clock to provide the most informative, easy-to-use, and trustworthy experience possible. They have helped many of our customers invest in their retirement accounts for the first time. Behind the scenes, we have been laying the foundations to continue the explosive growth of Lendtable. Specifically we:

- Completely redesigned our landing page and app to provide a delightful experience to our customers when they first discover Lendtable.

- Launched our Lendtable ESPP Cash product, which now represents roughly 20% of Lendtable users.

- Indexed thousands of 401(k) plans and set up integrations with providers like Atomic and Docusign to get our customers through our entire form submission in 5 minutes or less.

- Launched partnerships with companies like SuperCoffee, where we decreased the number of users missing out on their 401(k) match by 15% in our first two weeks working with the team.

- Set up a world-class marketing team to meet our users where they are and on their terms.

- Invested heavily in customer success, committing to a median customer response time in under 1 minute, and crushed that goal, hitting 45 seconds over the past year.

-

Provided $3 million towards people’s benefits, furthering our mission of

making retirement a possibility for our customers with every dollar

lent.

Our fundraise would not have been possible without all this hard work, so I want to thank the people who make this journey fulfilling. Sheridan — you are the best co-founder I could ever ask for, and I am so glad we turned our first coffee chat into an all-night brainstorming session that led to the creation of Lendtable. Isaiah, Yav, Richard, Celena, Ani, Mike, Michael, Serena, Mayan, and Steph, Lendtable would be nothing without your steadfast commitment to our customers and your work building a company whose culture represents its user base.

Going forward, there is much to do. It is time for us to begin working on our larger vision. Lendtable Cash is the seed capital for a lifelong customer relationship. Over the next year, we will build out services that both support and supplement Lendtable Cash and our user's overarching investment experience. Our key to success is the trust we earn by powering our customers' (many of whom are investing for the first time because of Lendtable) retirement savings. We have an enormous responsibility to make that investing journey as simple as possible, and we believe we've earned enough customer trust that they will adopt future products we offer.

The road ahead will not be an easy one, but it is certainly worth traveling. Our job is only 1% finished. We do not have time to waste, and we have a lot to build. If you want to join us on this journey, check out our careers page and get in touch. We are looking for talented people like you to champion our mission if we are going to make retirement a possibility for every American.

About Lendtable

Lendtable is a startup company set to solve the long-term savings and liquidity problem. Each year $24 billion in employer 401(k) matches are left on the table, primarily because employees cannot afford to both save for the long term and pay for daily expenses. Lendtable helps employees unlock this portion of their paycheck by supplying them the funds they need to receive their full 401(k) match from their employer. With Lendtable, they no longer need to choose between saving for retirement and covering day-to-day expenses.

Founded in 2020 in San Francisco, the company is led by founders Mitchell Jones and Sheridan Clayborne. Mitchell previously founded Parable, an automated personal financial assistant fintech startup. Before Parable, he worked as a fintech product manager at Facebook, leading their digital wallet product for LATAM and Dropbox in cybersecurity. Mitchell graduated from Yale University. Sheridan, a Thiel Fellow, was the youngest Black American to get into Northwestern at age 15. He went on to work at Goldman Sachs in private equity and Dropbox as a machine learning product manager. Sheridan has built multiple fintech and e-commerce startups and has done over $20 million in sales through these ventures.

For press or media inquiries, please contact:

Celena Chong: celena@lendtable.com

Mitchell Jones

Mitchell Jones